Why your claim reimbursement may look different in January

Wednesday, Mar 19, 2025Noticing higher prescription costs or paying more for physiotherapy early in the year? Don’t worry – we’re here to help you understand why.

If your claim reimbursements seem different at the start of the year, you're not alone. Changes in out-of-pocket costs for prescriptions or health care services can happen due to several reasons. Here are three factors that could be affecting your claims at the start of the year.

Benefit plan deductible

What is a deductible?

Simply put, a deductible is an amount you pay out-of-pocket before your insurance starts covering costs. For example, if your deductible is $100, you’ll pay for medical expenses until you reach that amount. Once you’ve met the deductible, your insurance will start covering the remaining eligible costs.

Deductibles vary by plan and may apply per person or per family. Check your Member Profile for specific details on your plan or visit Understanding deductibles to learn more.

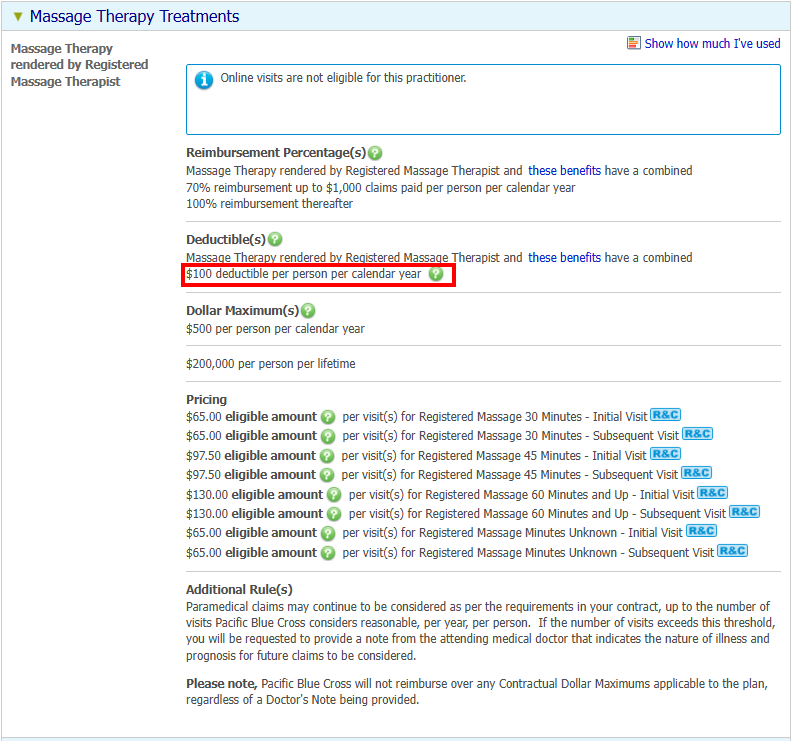

The image below shows a benefit plan that has a $100 deductible per person, per calendar year. This means the deductible will refresh at the start of each calendar year, or January 1.

While you may pay more at the start of the year, your coverage remains the same, and you’ll spend less as the year progresses.

Sliding co-insurance

What is co-insurance?

Once you meet your deductible, your insurance will begin covering your eligible costs, but you may still need to pay a portion. Co-insurance is the percentage you pay after your deductible is met. This amount depends on your plan and the benefit type.

For example, your plan may cover:

- 80% of prescription drug and health services, leaving you to pay 20%, or

- 50% of major dental services, with you paying the remaining 50%.

Your exact co-insurance percentage varies based on your plan.

What is sliding co-insurance?

Some plans have a variable co-insurance structure. This means your reimbursement rate increases after reaching a set claim amount within a calendar year.

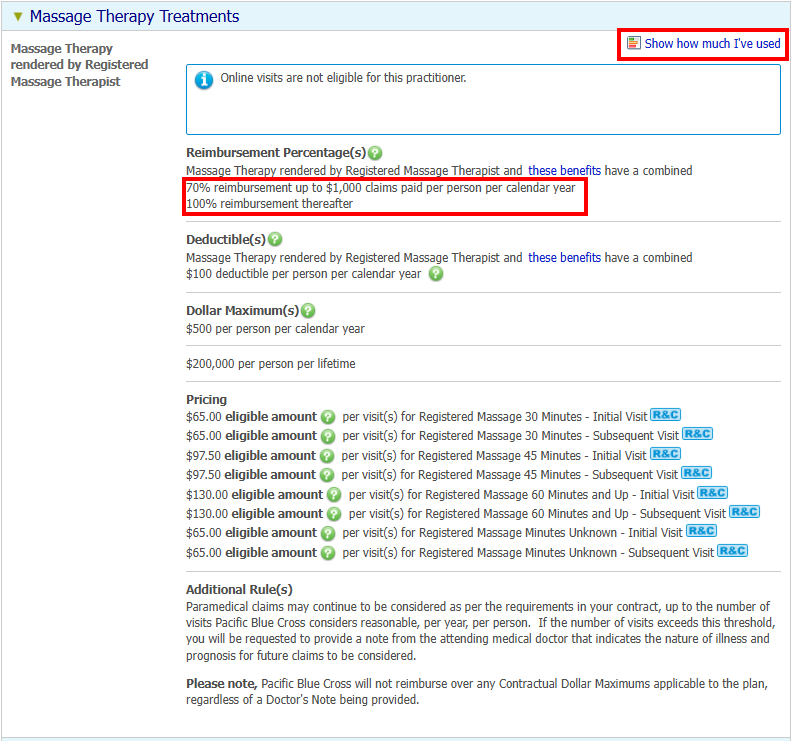

In Member Profile, you can check your deductible and co-insurance percentage details. Simply search for a benefit and click on See how much I’ve used in the top-right corner.

The image above shows a benefit plan where:

- Massage therapy with a registered massage therapist is reimbursed at 70% until you reach $1,000 in claims per person per year.

- After that, reimbursement increases to 100% for the rest of the year.

PharmaCare deductible (specific to BC residents)

Fair PharmaCare, a provincial government program, helps families residing in British Columbia pay for many prescription drugs, dispensing fees and some medical devices and supplies. The plan is income-based – families with lower incomes receive more financial assistance.

Family deductibles and maximums

- Family Deductible: The amount a family must spend on eligible costs each year before PharmaCare starts to pay for eligible costs.

- Family Maximum: The most a family will pay out-of-pocket in a year on eligible drugs, fees and medical supplies. Once reached, Fair PharmaCare pays 100% of their eligible costs for the rest of the year.

The PharmaCare deductible resets each calendar year on January 1, meaning you must meet your deductible before PharmaCare starts to provide assistance.

Your health plan covers prescription costs while PharmaCare is not yet contributing.

Learn more at Understanding Fair Pharmacare: The BC government’s drug plan.

BC government resources on Fair PharmaCare

- Fair PharmaCare Plan – Learn about eligibility, coverage, registration, and information on deductibles and family maximums.

- Estimate your deductible based on Fair PharmaCare assistance levels.

What else can impact your claim reimbursement?

- Reasonable and customary limits

- Coordination of benefits

- Pharmacy dispensing fees and drug mark-up costs

* This example is for illustration purposes only. Actual figures may vary depending on your plan details.